There’s no doubt the recent economic headwinds have reshaped the Australia and New Zealand (ANZ) commerce landscape. In 2023, online and offline retailers saw a resurgence of discount-seeking consumers due to the impact of inflation and high interest rates.

While these economic influences won’t disappear in 2024, there is optimism that things will get better for the retail sector. For one, the Australian retail market, which was valued at AUD 358.9 billion in 2022, is expected to maintain steady growth with a Compound Annual Growth Rate (CAGR) of over 3% projected until 2027.

According to Deloitte, 2024 should also offer a moderation of inflation that will provide a return of real wage growth, helping to stimulate consumer spending. Deloitte also anticipates that retail activity will increase in 2024 due to population growth and a possible end to the Reserve Bank of Australia (RBA) cash rate hikes.

Nevertheless, the ANZ retail sector continues to face challenges as consumers remain cautious with discretionary spending. This is why consumer confidence (63%), inflation (57%), and discounting (19%) remain some of the biggest challenges ANZ retailers say they will face in 2024.

Source: Australian Retail Outlook 2024

To navigate these issues, commerce brands must balance cost-saving measures with investment in growth opportunities and innovation while keeping the customer experience front and centre. This report looks at six key areas impacting ANZ retailers in 2024 and how they can adapt to succeed:

- Consumer behaviour: Pressure on retailers rises

- Regulatory environment: Adapt to maximise savings

- Sustainability: Shift to sustainable strategies to win consumers

- Cross-channel commerce: Tap into the potential

- Omnichannel experiences: Create experiences consumers crave

- Technology innovations: Invest or fall behind

1. Pressure on retailers rises with consumer expectations

Consumer behaviour in ANZ commerce has notably shifted over the past year. Amid the current environment of economic uncertainty, regional consumer expectations are now higher, especially among Gen Z and millennials. ANZ consumers are also excited for brands to use generative AI, which can offer greater personalization.

Additionally, Deloitte reports that ANZ consumers are increasingly avoiding discretionary spending, creating a significant gap between food and non-food retail sales growth. Food sales have seen a modest increase of 0.6% in real terms, whereas non-food retail sales have declined by 4.2% or a 6.1% decline in per capita terms.

The main ways consumers are trying to dial back spending include the use of promotional codes, cashback offers, and rewards. Almost half of consumers (47%) are shopping for lower-priced brands than they did in the previous 12 months, and many are also shopping more at sales events like Black Friday and Cyber Monday.

In response, non-food retailers are resorting to discounting, with department stores and household goods leading in sales during the September quarter, facilitated by price declines of 0.2% and 0.4%, respectively.

Changing demographics in ANZ, such as an ageing population and the rise of the Gen Z consumer, are also forcing retailers to adjust their marketing and advertising strategies. Not only do Gen Z consumers want brands to connect with them on social media, but they also want to receive personalised recommendations and are turned off by ads that aren’t relevant to them.

Source: 2024 Australian and Consumer Retail Trends

How to adapt

In response to evolving consumer behaviour, commerce brands are implementing dynamic pricing strategies and using first-party data to enhance customer experiences with greater personalization. To make these shifts possible, commerce brands must start by:

- Collecting first-party data from various touch points such as websites, mobile apps, social media platforms, and points of purchase.

- Channelling first-party data into a unified customer profile (UCP) to gain a comprehensive understanding of individual customer behaviours.

- Implementing technology that supports personalised search, product recommendations, and dynamic product ranking to identify upsell and cross-sell opportunities and enhance the overall shopping experience based on real-time data insights.

2. Adapt to regulatory changes to maximise savings

Agreements and regulatory changes can significantly influence business strategies for retailers. The GST (Goods and Services Tax) is particularly important to commerce brands as it directly impacts working capital by affecting inventory management, procurement costs, and tax payment timelines.

In the last couple of years, there have been significant changes related to the GST (in Australia and New Zealand.

These include:

- GST invoicing rules: In New Zealand, new rules for GST invoicing were enacted, effective April 1, 2023. These rules introduce new concepts like Taxable Supply Information (TSI) and Supply Correction Information (SCI). Additionally, remedial GST changes were introduced to amend the new rules further.

- ANZ fee changes: ANZ made changes to its fees and rates due to GST, affecting pricing on some products.

Recent trade agreements have also reshaped the landscape of e-commerce operations in ANZ, aiming to reduce barriers and enhance efficiency in digital trade. Noteworthy developments include:

- UK-Australia Free Trade Agreement: Signed in late 2021, this agreement addresses crucial aspects of e-commerce, such as the legality of electronic contracts and measures to mitigate spam and misleading product representations in online marketplaces. Moreover, provisions facilitating the freer movement of data between the UK and Australia support remote servicing models prevalent in contemporary e-commerce ecosystems.

- Customs procedures and logistics: Simplified customs procedures outlined in the UK-Australia FTA promise expedited release of imported goods, fostering efficiency in logistics management for e-commerce entities. These streamlined processes enhance supply chain dynamics, bolstering the competitiveness of businesses operating within the digital realm.

How to adapt

To mitigate the effects of these changes, commerce brands should focus on optimising regulatory compliance and exploring input tax credit benefits. This can be achieved by:

- Optimising regulatory compliance efforts to adapt to changing requirements.

- Exploring input tax credit benefits to maximise tax savings.

- Adopting technology-enabled financial management systems, such as a retail POS solution integrated with leading e-commerce, accounting, and payment software, to streamline processes and ensure compliance.

3. Shift to sustainable products to win consumers

Consumers in ANZ strongly prefer sustainable and green products, with 80% of Australian shoppers saying sustainability is a consideration when deciding what products to buy. Sustainability is particularly important for Gen Z, with 62% of young ANZ consumers showing a preference for sustainable products. Additionally, approximately 82% of ANZ consumers favour recyclable packaging materials, indicating a widespread interest in environmentally friendly options.

However, ANZ retailers face challenges in integrating sustainable practices due to factors such as insufficient government support and perceived implementation costs. Currently, ANZ businesses lag behind their regional counterparts, with only 48% of ANZ businesses having implemented sustainable IT practices. Barriers to adopting sustainability practices cited by ANZ commerce brands included lack of clarity from governing bodies (50%) and cost of deployment (48%).

How to adapt

Progressive ANZ commerce businesses aiming to enhance consumer trust and reputation should integrate sustainability and ethical sourcing into their strategies, focusing on local, sustainable, and ethical brands. This can be achieved by:

- Prioritising products sourced locally, sustainably, or from ethical brands.

- Publishing regular updates on efforts to meet specific Environmental, Social, and Governance (ESG) objectives.

- Emphasising transparency in communicating sustainability and ethical sourcing initiatives to consumers.

4. Tap into potential of cross-border commerce

Nearly one-fifth of ANZ retailers have made expansion into new markets a top priority for 2024. With only 6% of international shoppers currently buying from Australia, there is clear potential for cross-border expansion.

However, conditions remain challenging. As opposed to 2022, when 48% of retailers said trading conditions were good, the latest survey showed that only 26% of retailers felt trading conditions were good, and 40% felt that they were ordinary. When asked how trading conditions might change in 2024, one-third anticipated conditions to remain the same, and only 12% were hopeful of seeing a significant change.

Legal and tax implications add complexity and challenges to ANZ commerce brands hoping to expand into international markets. However, initiatives like the Te Aoutanga Aotearoa Southern Link, which proposes developing New Zealand as a southern hemisphere trade hub, allows increasing trade between China/Asia and South America and interconnectivity between New Zealand/Australia and the Pacific Islands, are also opening new cross-border opportunities.

Source: Australian Retail Outlook 2024

How to adapt

ANZ retail brands looking to tap into new markets must embrace technology that can help expand their global footprint. They can do this by:

- Accelerating digitisation efforts to stay competitive in the global market landscape.

- Investing in an ecommerce platform that seamlessly integrates marketing, customer data, commerce management, search, retail operations, and customer service can make it easier to reach international markets efficiently.

- Delivering personalised experiences that cater to cultural nuances and strengthen the relationship with global customers.

- Enhancing supply chain efficiency, including managing suppliers, imports, and Cost of Goods Sold (COGS), to ensure seamless operations and a more agile response across international borders.

- Prioritising cybersecurity to foster trust and reliability among global consumers.

- Seizing new opportunities for growth and expansion in international markets.

5. Create omnichannel experiences consumers crave

A substantial proportion of ANZ shoppers (89%) say it is very or quite important to prioritise a consistent experience across different channels. This underscores the growing expectation for seamless omnichannel experiences to meet consumer needs and preferences.

Moreover, 9 in 10 Aussies expect retailers to sell their products online, and 84% of Kiwis and 91% of Aussies interact with brands via two or more different channels, such as in-store, website, and app. ANZ consumers also respond more positively (52%) to brands that connect them both online and offline versus those that only interact with them on one channel.

How to adapt

ANZ retailers are recognizing the imperative of integrating online and physical retail experiences to cater to evolving consumer expectations for seamless omnichannel journeys. To achieve this goal, retailers are:

- Identifying the channels to integrate within their omnichannel strategy to ensure consistency, including synchronised inventories, pricing, and promotions across all channels.

- Aligning online and in-store experiences, including providing omnichannel fulfilment to cater to diverse customer preferences and needs.

- Investing in a commerce platform capable of integrating marketing, customer data, commerce management, search, retail operations, customer service, and other relevant systems.

6. Invest in technological innovation or fall behind

Continued investments in technology are required to respond to industry challenges, including the need to engage customers across both physical and digital channels while expanding reach to new audiences. Innovation in retail and inventory management is also needed in the ANZ retail sector. Most commerce brands agree.

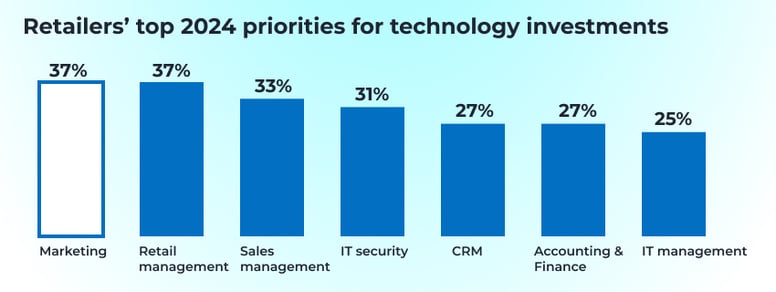

Gartner reports that 57% of global retailers (including Australia) plan to increase spending with a focus on marketing and IT technologies. Gartner noted that retailers are directing their software investments towards retail management and sales management to meet the demands of omnichannel shopping experiences and cater to the preferences of Gen Z shoppers.

Retailers’ top 2024 priorities for technology investments

Source: Gartner

How to adapt

ANZ retailers must prioritise investments in digital, data, and customer insights to meet evolving customer expectations. To do this, retailers must start by:

- Enhancing the customer experience through machine learning- and AI-driven personalization, intelligent search tools, and integrated unified customer profiles to meet the growing demand for tailored recommendations and seamless product discovery.

- Addressing inventory challenges by investing in retail management technology that optimises stock control through automated replenishment and real-time tracking, leading to improved supply chain efficiency and reduced errors.

- Prioritising IT security software to ensure robust consumer data management and privacy compliance in the face of intensifying digitization and personalization efforts in the retail landscape.

Future growth depends on innovation and adaptation

The outlook for ANZ retail and e-commerce is seen as positive overall, with retailers seeing steady growth fuelled by technological advancements and evolving consumer preferences. Ecommerce in the region is expected to experience robust expansion, with predictions indicating the market will see a 13.7% CAGR between 2022- 2027.

While ANZ currently trails behind in ecommerce sophistication compared to other regions, continued investment in infrastructure and digital transformation initiatives presents significant opportunities for catch-up growth. Retailers and e-commerce businesses have opportunities to differentiate themselves through next-level personalization, sustainable practices, and improved retail and inventory management.

The concept of unified commerce, which seamlessly integrates online and offline channels, is also gaining prominence due to its ability to provide consistent and cohesive shopping experiences. Unified commerce in Australia is currently valued at AU$44 billion, but there is a potential for $30 billion growth for the retail sector if more businesses adopt such solutions.

To stay ahead in a competitive and dynamic market landscape, ANZ retailers must position themselves for sustained growth. The best way to do this is by embracing innovation and addressing challenges head-on.

Be ready for what’s in store

Maropost offers a full suite of retail and ecommerce solutions, including Neto, Retail Express, Marketing Cloud, Service Cloud, and Findify. This makes it easy to meet rising consumer expectations by optimising marketing, customer data, commerce management, search, retail operations, and customer service. Designed for both retail and ecommerce businesses, Maropost solutions provide a comprehensive ecosystem, ensuring personalised experiences, efficient commerce, and advanced analytics.