Ecommerce and Retail

One of the most obvious and important decisions for your ecommerce business is in fact the commerce side of things. The payment. Exchanging your hard earned goods for your customers’ hard earned cash.

In this age of digitization, it’s not surprising that there’s a world of ecommerce payment systems available to you and it seems to be growing by the day. What’s more, research suggests that up to 24% of online shoppers will abandon their shopping cart if their preferred payment method isn’t available. It’s quite simply something that you need to get right, early on in your business lifecycle.

With shopping cart abandonment rates sitting at around 70%, there are a number of strategies you can adopt to improve conversion but one of the most important is to offer a multitude of payment options. You also need to ensure that these payment gateways are seamlessly integrated into your website. The last thing you need is a shopper losing trust in your business because you’ve sent them down a digital rabbit hole.

So let’s explore some of the leading ecommerce online payment systems available to you:

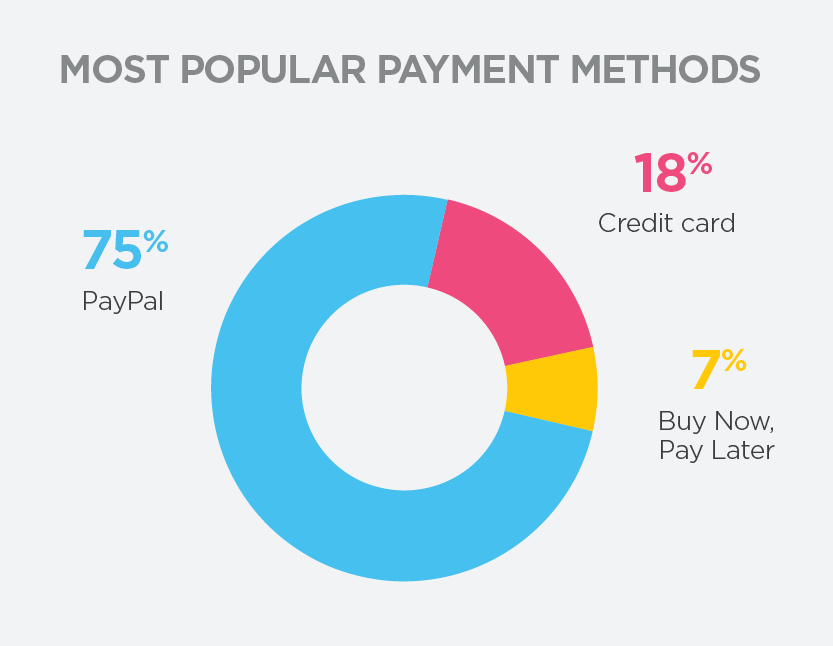

In our 2017 State of Ecommerce Report, we found that PayPal was by far the most popular way to pay online with 73.1% of payments being processed through this provider – one of the very first online payment systems available in Australia. It’s a little different to some of the other ecommerce payment options in that it’s classified as a managed bank transfer service. Both the merchant and the customer set up an account where they can deposit, withdraw and transfer cash. Payments cost nothing for customers but your business will be charged a fee of 2.65% per transaction. Neto also offers PayPal Express Checkout, which saves time and potentially turns your one time shopper into a loyal customer who loves your ease of transaction.

Visa, MasterCard, American Express and Diners Club – accepted the world over, credit cards are still one of the most popular methods of payment, both online and offline. And this also includes the prepaid or debit versions of the cards. Our State of Ecommerce Report found that credit card transactions accounted for 22% of total payments online. Your bank is ultimately responsible for processing your online transactions but you will need to sign on with a payment gateway provider… which we’ll get to shortly.

With the emergence of Afterpay, zipPay and zipMoney, the ‘buy now, pay later’ option for ecommerce shopping is growing by the second. In fact, in 2017 these types of transactions grew by 147%, now accounting for over 3% of total sales. We get into the nitty gritty details in our ‘buy now, pay later’ blog article but essentially these methods allow customers to set up an account and make limited purchases which are then paid off over an agreed period, with no interest or additional fees if the customer stays within the terms of agreement. For merchants there is a percentage fee, which varies depending on your trading volume (somewhere around 4-6%). Afterpay also has a 30c transaction fee. Then there’s zipPay’s big sister zipMoney, which is designed for ‘life’s larger purchases’ and involves a credit check and longer payment periods.

| Related reading: Afterpay, zipPay and zipMoney: How Buy Now Pay Later Works and Why Retailers Are Going Crazy for It

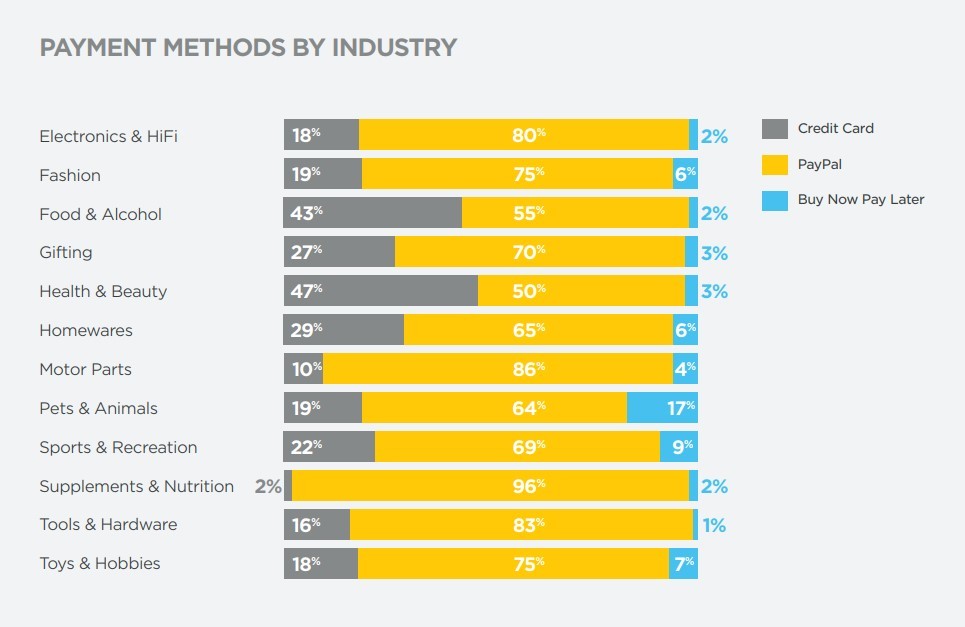

Before making a decision about your online payment methods, we suggest taking a quick look at our industry graph. While PayPal is leading the pack there are some big differences in preferred payment methods between industries and these nuances need to be taken into consideration.

If you’re using Neto, PayPal, credit cards and ‘buy now, pay later’ payment methods are all seamlessly integrated and can be preconfigured from your dashboard. All you need to do is connect your PayPal account plus your Afterpay or ZipPay account, and select your preferred credit card payment gateway. If you’re using another retail platform, you may have to install these payment methods as third party add-ons.

A payment gateway is essentially the conduit between your ecommerce website and a bank; if you want to accept credit card payments online, then you need a gateway to do so. The gateway securely sends credit card and other key information contained in an online transaction from the website to the credit card payment processor, determines its validity, authorizes the transaction, and sends a message back to the site confirming that it’s been successful. Some payment gateways also provide fraud protection mechanisms which you can read more about here.

When it comes to payment gateways, there are a number you can choose. We’ve done some of the hard work for you and detailed the world-leading providers here, and to take it a step further, we’ve partnered with them to make it easy for Neto retailers to accept payments online.

All of these payment gateways offer strong security settings and advanced fraud protection as well as 24/7 support. It’s worth checking the kind of support on offer though; they may not all be local, real people. You should also further investigate the fees and charges that apply especially for international cards, Diners and Amex as well as wallet payments.

There’s always going to be a small percentage of people who would just prefer to deposit directly into your bank account. And if you have the capacity to handle the manual nature of processing of these transactions, why not offer it. Just be sure to spell out that orders will only be dispatched after funds have been cleared.

Direct deposit is your most obvious bank transfer method and you’ll have to rely on your customer including an order/invoice number in the reference field of their transfer to allow you to process and complete the order. Alternatively, Neto also integrates with BPAY which makes keeping track of the payment that much easier. The payment gateway generates a biller and reference number which the customer then uses within their own online banking. It’s also much quicker to process, meaning the customer’s order is dispatched sooner. Win-win for all.

Not only are gift vouchers a great way to generate new revenue streams, it’s also yet another method of payment available to your customers. And vouchers will often require the shopper to top up their payment via another method.

By introducing gift vouchers to your store and payment methods you’re also increasing the reach of your brand. Whether it’s a loyal customer buying cards to share with their loved ones, or the other way round, your ecommerce business is getting just that little bit more love. Gift vouchers are also an ideal reward for loyal customers or even an easy way to deal with customer service issues or other situations that require a credit to be issued.

Whether you operate a permanent bricks and mortar store or just the occasional pop up store at markets and expos. You’ll also need an EFTPOS system that integrates with your point of sale system and ecommerce platform. Many of the payment gateways offer this option, as does Neto with Neto POS. Check out our tips on what you should be looking for when selecting an EFTPOS system.

Did you know, Neto offers customers the option of using multiple types of payment in a single sale?

In addition to offering a range of payment options for your retail customers, you also need to consider wholesale customers who will expect additional options and flexibility with timing. Neto includes:

Batch payments: Apply a single payment to multiple orders

Accounts: Offer invoice terms which let wholesale customers pay on a 7, 14 or 30 account with monthly statements generated for account customers. You can also set up automatic payment reminder emails so that you don’t have to manually chase every outstanding invoice.

Recurring payments: Set up recurring payment plans with inbuilt triggers for invoice payments.

Accounting Integration

All of your payment options will eventually make their way to your business bank account or in the case of PayPal you’ll need to transfer it yourself. But as your business grows, have you considered just how time consuming the reconciliation process will become between your orders, your payment gateways and your bank account? That’s when it becomes vital to integrate an accounting software package with your Neto Platform. Options include Xero, MYOB, Saasu and Quickbooks.

Interested in learning more about accounting software? Check out our recent article Which Account Software is Best for Your Ecommerce business?

As we mentioned in the beginning, the options available for online payment systems are growing by the day. We haven’t even touched on some of the others including Bitcoin, Square, Clover, First Data and Klarna.

Neto has partnered with providers that offer options to suit every kind of ecommerce retailer across a broad range of industries, all seamlessly integrated into the retail platform in a single checkout page – secure and real time. A multitude of payment methods will ensure a crowd of happy customers. Isn’t it time you took your online store to the next level and made it easy for customers to pay you? Set up your online payments today.